Most business owners didn’t start their company to spend evenings sorting receipts, labeling expenses, or trying to remember what that mysterious “STRIPE 8392” charge was for. Yet for many founders, bookkeeping quietly becomes a second job, one that’s tedious, easy to postpone, and incredibly stressful when tax season rolls around. The problem isn’t that bookkeeping isn’t important; it’s that the traditional way of doing it relies heavily on manual work, perfect memory, and endless spreadsheets. What’s changing now is that you don’t have to accept this as the default. AI is making it possible to automate much of the busywork and turn bookkeeping from a drain on your time into something that mostly runs in the background.

What AI Bookkeeping Means?

At its core, AI bookkeeping isn’t about replacing accountants or adding complicated new software to your stack. It’s about automating the parts of bookkeeping that are repetitive and machine-readable. Instead of you manually downloading statements, copying numbers into spreadsheets, or deciding how to categorize every transaction, AI can automatically pull in your bank and credit card data, read invoices and receipts, recognize patterns, and organize your finances in a consistent way. Think of it less like “robot accounting” and more like having a smart assistant that handles the busywork so you can focus on running your business. AI bookkeeping specifically can help with the following:

1. Data capture

With AI, the way your financial data gets into your books fundamentally changes. Instead of you hunting down files, AI-powered bookkeeping tools can connect directly to your bank accounts and credit cards and pull in transactions automatically as they occur. They can also read invoices and receipts you upload or forward, extracting key details like vendor, date, and amount without you having to type anything in.

2. Understanding and organizing transactions

Once your data is in, AI doesn’t just store it, it makes sense of it. In practical terms, that means cleaning up messy, inconsistent transaction records that would normally trip up a human.

For example, AI can recognize that “GOOGLE *ADS,” “Google Ads 9983,” and “Google Advertising” all refer to the same vendor and standardize them under one name. It can also automatically categorize your spending — labeling costs as software, advertising, meals, supplies, or other relevant categories based on patterns it learns over time. On top of that, AI can match receipts to the right transactions, reducing the back-and-forth of “which receipt goes with which charge?”

This is where AI starts to feel less like a tool and more like an always-on digital bookkeeper quietly keeping your records organized.

3. Producing usable outputs

All of this automation ultimately serves one goal: giving you financial information that you can actually use.

With AI bookkeeping, you can see your profit and loss in near real time instead of waiting weeks for a manual update. You can track your expenses throughout the year rather than trying to reconstruct everything at the last minute. And when tax season comes around, you’re far closer to being “tax-ready” instead of scrambling in March or April to make sense of months of messy records.

Future of Bookkeeping

The landscape of bookkeeping is rapidly evolving, with AI positioned as a powerful ally for both business owners and financial professionals.

AI Empowers Bookkeepers

The rise of AI does not signal the obsolescence of human bookkeepers but rather an evolution of their role. By automating mundane, repetitive tasks, AI frees bookkeepers to focus on more strategic, high-value activities such as financial analysis, forecasting, tax planning, and providing actionable business advice. This transforms the bookkeeper from a data entry specialist into a strategic financial partner, making their role more valuable and engaging.

Small Business Impact

For small business owners, AI brings unprecedented clarity and control. Despite 75% of U.S. small businesses leveraging AI in some capacity in 2025, only 38% reported real-time cash flow visibility [fintechtakes.com]. This highlights a significant opportunity for AI bookkeeping software for small business to bridge this gap, providing instant, up-to-date insights into financial health.

Furthermore, AI-driven tax preparation services are expected to lower small-business filing expenses compared to traditional human preparers [cpatrendlines.com]. This real-time clarity, combined with reduced manual effort and improved accuracy, allows small business owners to make more informed decisions, manage cash flow effectively, and reduce financial stress.

How to Use Fyno AI Bookkeeping Software

Rather than being “just another accounting app,” Fyno acts like an AI layer on top of your finances — a smart assistant that helps automate your bookkeeping tasks, turning raw financial files into organized, usable records.

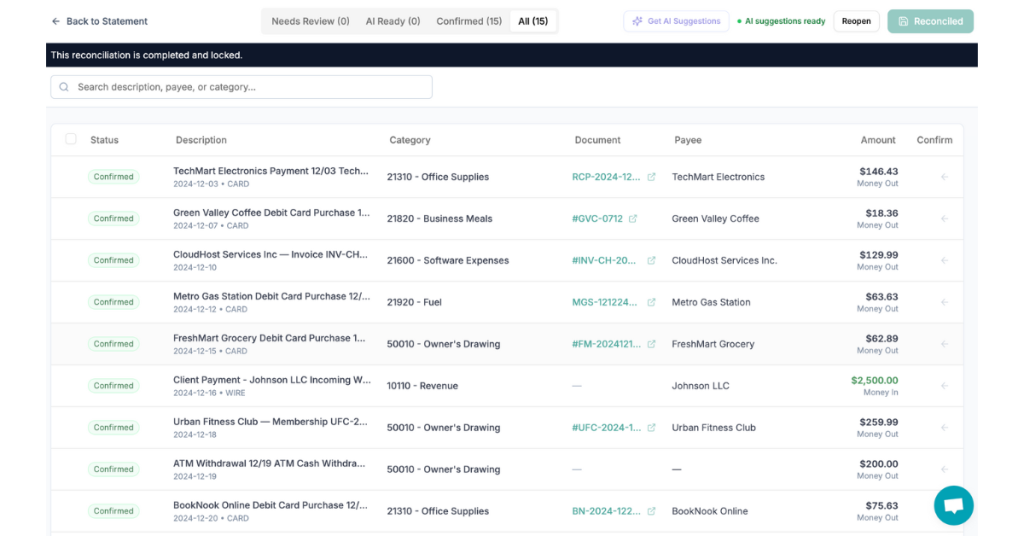

Instead of manually keying in transactions, you can upload or email your bank statements (PDF or Excel) along with your invoices and receipts to Fyno. From there, Fyno AI automatically extracts the relevant transaction data, cleans it, and organizes it in a consistent way. It standardizes messy vendor names, categorizes expenses, and matches receipts to the right transactions, reducing the amount of manual sorting you’d normally have to do.

What makes Fyno different from traditional automation is that you can teach it like a human. You can set rules in plain, natural language, for example, “Anything from Shopify should be tagged as Sales,” or “All Google charges are advertising.” Fyno applies these rules consistently, but it also learns from your behavior over time. When you make corrections or adjustments, the system remembers and gets better at handling similar transactions in the future.

Importantly, Fyno doesn’t blindly guess. When it’s uncertain about a transaction, it flags it for you with a confidence score instead of making a risky assumption. You can quickly review, confirm, or adjust, and that feedback further trains the system.

In practical terms, this means your books stay much closer to up-to-date with far less effort on your part. You get a clearer view of your profit and expenses, and you’re less likely to face a chaotic scramble when tax season arrives. By combining automated data extraction, intelligent organization, human-friendly rules, and learning over time, Fyno AI helps make bookkeeping feel less like a chore and more like an invisible support system for your business.

As AI continues to evolve, embracing these tools means moving beyond manual entry and towards a world of real-time insights and effortless financial management. For small business owners seeking the easiest, AI-native solution that brings clarity and control, tools like Fyno are redefining what’s possible in bookkeeping.

Can ChatGPT do my bookkeeping?

No, ChatGPT is a language model, not a bookkeeping software. It can assist with questions but cannot process transactions or generate financial reports.

Will AI replace my bookkeeper?

AI automates routine tasks, freeing bookkeepers to focus on strategic advice and complex analysis, making their role more valuable, not obsolete.

How accurate is AI bookkeeping?

AI bookkeeping is highly accurate for data extraction and categorization, cutting manual errors by up to 90%, especially with human review. This significantly reduces human error from manual entry [accountancyage.com].

How can AI help with tax season?

AI streamlines tax preparation by keeping accurate, categorized records throughout the year, making financial reporting and submission much faster. Recent analyses suggest AI-driven tax preparation services are expected to lower small-business filing expenses versus traditional human preparers [cpatrendlines.com].

Can I use AI with QuickBooks?

Many AI bookkeeping solutions integrate with platforms like QuickBooks and Xero, automating data entry and reconciliation within your existing accounting ecosystem.